isa rentals

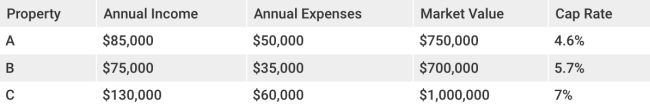

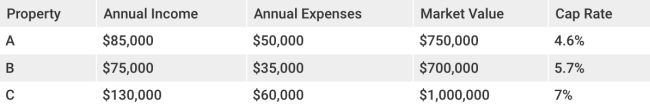

There are many regional variations. However, generally speaking, lower capitalizations rates of 4-5% would make an asset class A or B.

There are however regional variations to cap rates. A NYC cap rate of 6 percent will be different for a property than it is in a rural area. It is a good rule to remember for real estate investors that cities with higher population tend to have more cap rate compression. Also, their capitalization rates are generally lower on average.

With that being said, appreciation is only a theory and can happen depending on the market. Rent and net operating revenue are likely to be more predictable that the market. Remember, the income of a building isn't your only source of income in real estate.

There are many regional variations. However, generally speaking, lower capitalizations rates of 4-5% would make an asset class A or B.

A caprate is only a snapshot from the present. The cap rate takes current income and costs. However, the formula does not take into account any new renovations or marketing changes. These changes can lead to a caprate that is higher or lower depending on the length of the investment term.

Bottom line: What does a good caprate look like for multifamily property? There is no one "good caprate real estate" answer to this question. Cap rates are based on many factors including risk appetite, location and cost of living.

Cap rate does not take appreciation into account. Multifamily properties may appreciate. This impacts the determining factor for what makes a multifamily property a good investment. As an example, consider the San Francisco cap rate. It is so worth it that the ROI has been low in the past.

As you likely know, cap rate are only one aspect to a deal. They are an important and essential part of any deal, but they are only a single aspect.